tax loss harvesting crypto

Make tax-loss harvesting part of your year-round tax and investing strategies. Capital gains receive the most preferential tax treatment of dividends interest and capital gains so it makes sense to hold investments such as stocks shares and mutual funds in a non-registered account and leave the higher-taxed items in a registered vehicle where they can grow tax-sheltered.

Simplify Crypto Tax Loss Harvesting With Koinly Ambcrypto

The strategy known as tax-loss harvesting allows you to sell declining assets from your brokerage account and use the losses to reduce other profits.

. SEC- and Big Four-grade solution for digital asset accounting. Tax Loss Harvesting. You can use up to 3000 in capital losses to offset other income 1500 if married filing jointly.

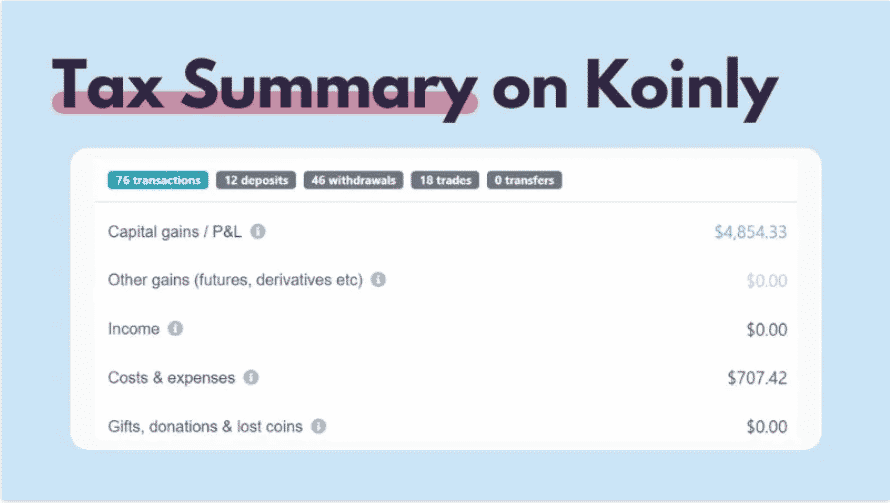

Youll be able to. With automatically generated tax forms and reports like our crypto tax loss harvesting dashboard youll save time stay prepared and make more strategic tax decisions. Professional portfolio managers like Fuse who specialize in this area even build portfolios with their tax strategy in mind.

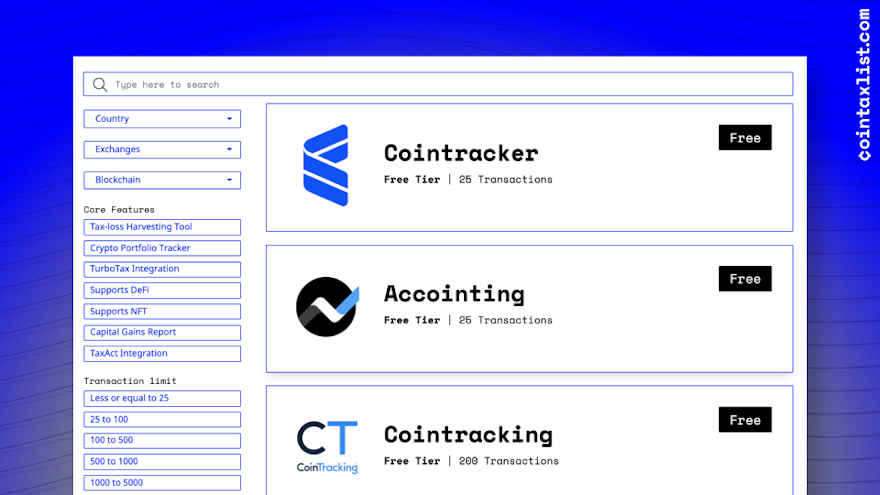

It provides you with a tax-loss harvesting tool using which you can pay fewer taxes. Tax Optimization and Tax-Loss Harvesting. A wash sale is one of the key pitfalls to avoid when trying to take advantage of tax-loss harvesting to reduce your taxes and in falling markets such as in 2022 it can be valuable to make sure.

Plus it will reduce or eliminate much of the stress associated with crypto taxes and provide reliable and accurate tax reports. Plus 175 year. Many investors have mutual funds andor ETFs along with individual stocks in their taxable portfolios.

Tax on staking Earning staking rewards. Crypto tax software but also a full-service crypto tax accounting firm. To deter investors from selling their losing securities just to claim a quick tax deduction the wash rule prevents investors from buying a substantially identical asset 30 days before or after the sale of the funds chosen when conducting tax loss harvesting Note.

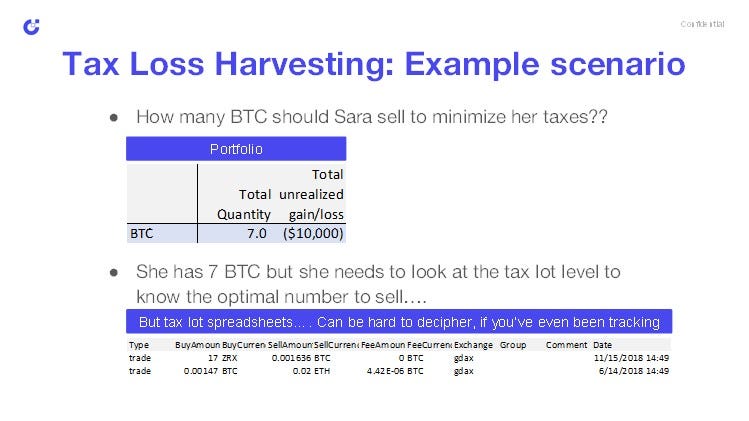

Completing a printable form. Tax-loss harvesting lowers current federal taxes by deliberately incurring capital losses to offset taxes owed on capital gains or personal income. Save on Capital Gains Tax with lot-level tax-loss harvesting data.

Ethereum gas fee report. Trading and Property Allowance. Tax loss-harvesting is the concept of recognising capital losses on CGT assets which can be used to offset against current or future capital gains.

Once losses exceed gains you can use the. Tax loss harvesting dashboard. UK crypto investors can pay less tax on crypto by making the most of tax breaks.

Tax-loss harvesting is an advanced investing strategy you can use to reduce your tax bill. The Best Crypto Exchanges Gold Price. Free crypto tax forms for individuals.

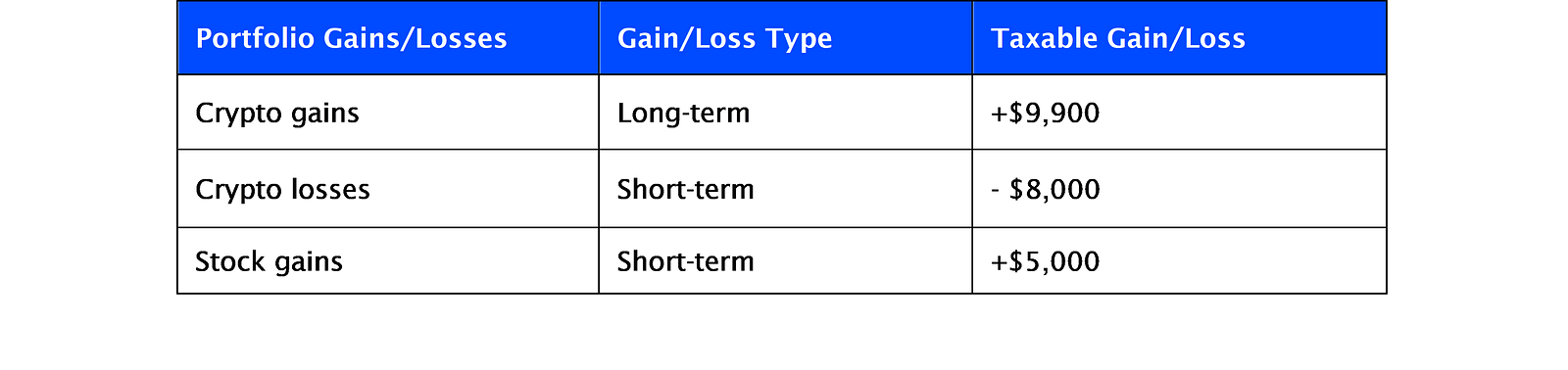

Strategically selling assets at a loss in order to offset your gains is called crypto tax loss harvesting. The wash-sale rule is in effect for a 61-day window because the rule. Dont Trigger the Wash Rule.

SEC- and Big Four-grade solution for digital asset accounting. Net unrealized appreciation and tax-loss harvesting are two strategies that could reduce taxable income. The first-ever Big Four-grade ERP solution for digital assets accounting.

Koinly is perhaps the most well-known of the choices in crypto tax software it has a clean easy-to-use interface and works great for beginners. Plus 175 year. Investing can be complicated even when you build a relatively simple portfolio of mutual funds and exchange-traded funds ETFsDeciding on the right asset allocation choosing the best securities to invest in monitoring your performance and rebalancing your portfolio takes effort.

Koinly combines crypto accounting and tax all in one software package. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins. Microsoft is quietly building an Xbox mobile platform and store.

Heres a guide to reporting income or capital gains tax on cryptocurrency. We enable and ensure regulatory compliance. CPA Review and IRS Audit Support.

Enterprise-grade solutions for all crypto tax compliance in one platform. The 687 billion Activision Blizzard acquisition is key to Microsofts mobile gaming plans. Certain strategies exist to alleviate the tax burden associated with 401k distributions.

Crypto tax software is a tool that allows you to prepare your taxes for your cryptocurrency assets. Be aware that selling an asset and rebuying it within 30 days is considered a crypto wash saleIn the US wash sales are not allowed for securities. Engage in tax-loss harvesting.

In the crypto market an investor could do. If the result is a loss follow the instructions on line 21 and use the Capital Loss Carryover Worksheet from the Instructions for Schedule D to calculate your deduction and enter the result on line 6 of Form 1040. Tax Optimization and Tax-Loss Harvesting.

All the forms you need. Automated CSV imports for all exchanges. The best way to maximize the value of tax-loss harvesting is to incorporate it into your year-round tax planning and investing strategy.

End-to-end data reporting and transaction reconciliation. One common tax-loss harvesting strategy is to sell an individual stock that has incurred losses and replace it with an ETF or mutual fund that provides exposure to the same asset class and often a similar segment of that asset class. These rules exist to prevent crypto investors from tax loss harvesting.

With us you can track gains calculate taxes and generate tax forms. With a Free plan you can import all your. CPA Review and IRS Audit Support.

Tax-smart ie tax-sensitive investing techniques including tax-loss harvesting are applied in managing certain taxable accounts on a limited basis at the discretion of the portfolio manager primarily with respect to determining when assets in a clients account should be bought or sold. Manual imports ICOs. This is a crypto tax solution that makes it simple to manage your taxes and it does it at a reasonable price.

For more on this practice visit our Guide to Crypto Tax Loss Harvesting. How to file crypto taxes MyTax. Enterprise-grade solutions for all crypto tax compliance in one platform.

Selling using or mining Bitcoin or other cryptocurrencies can trigger crypto taxes. 12570 Personal Income Tax Allowance. Form 1099 solutions for institutions.

It allows you to calculate the profit and loss from cryptocurrency trading calculate capital gains or losses and take deductions on expenses. Tax loss harvesting tool.

Tax Loss Harvesting On Crypto Your Plan For The 2022 Fed Rate Hikes Marathon Digital Holdings Quick Rundown Goodbye 2021 Rogue Retirement Lounge

The Taxman Is After Your Bitcoin Harvest Your Losses Before It S Too Late Bitcoin Magazine Bitcoin News Articles And Expert Insights

Find The Best Crypto Tax Software For Reporting Your 2021 Taxes

How To Turn Crypto Losses Into Tax Gains With Tax Loss Harvesting Zenledger Youtube

Save Big With Cryptocurrency Tax Loss Harvesting Cointracker

Crypto Losses Koinly Reveals 5 Tax Hacks You Need Now Press Release Bitcoin News

Tax Loss Harvesting How To Get Part Of The Money You Lost In Crypto Back From The Irs By Alex Miles Tokentax Medium

![]()

2022 Crypto Tax Loss Harvesting Guide Cointracker

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

.jpeg)

How To Report Crypto Losses And Reduce Your Tax Bill Coinledger

Cpa 3 Ways Savvy Crypto Investors Use The Tax Code To Their Advantage

Crypto Power Hour Tax Loss Harvesting Tips And Tricks Youtube

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

Simplify Crypto Tax Loss Harvesting With Koinly Ambcrypto

Crypto For Tax Loss Harvesting Is There A Better Way Etf Trends

Here S How Big Crypto Losses Can Benefit Your Taxes

Crypto Tax Loss Harvesting Turn Losses Into A Tax Benefit Sofi